mississippi auto sales tax calculator

Sales and Gross Receipts Taxes in Mississippi amounts to 53 billion. Mississippi Vehicle Tax Calculator.

Vehicle Mileage Log Expense Form Free Pdf Download

Mississippi Income Tax Calculator 2021.

. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Within Ruth there is 1 zip code with the most populous zip code being 39662. Tax Mississippi car tax is 189125 at 500 based on an amount of 37825 combined from the price of 39750 plus the doc fee of 275 minus the trade-in value of 2200.

Subtract these values if any from the sale. April 30 2022 nevada department of corrections hiring process. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart.

Home Motor Vehicle Sales Tax Calculator. The calculator will show you the total sales tax amount as well as the county. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

New car sales tax OR used car sales tax. The average cumulative sales tax rate in Ruth Mississippi is 7. The type of license plates requested.

DeSoto County Geographic Information System GIS. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Motor Vehicle Ad Valorem Taxes.

The exact taxable value will vary for your vehicle based on the MSRP and the available state tax incentives. Trade-in value tax rate tax savings. Before engaging in any business in.

Mississippi car tax is 189125 at 500 based on an amount of 37825 combined from the price of 39750 plus the doc fee of 275 minus the trade-in value of 2200. Less than 16 ft in length. Tax on a casual sale is based on the assessed value of the vehicle as determined by the most recent assessment schedule.

635 for vehicle 50k or less. Car tax as listed. The sales tax rate does not vary based on zip code.

Average Local State Sales Tax. This includes the sales tax rates on the state county city and special levels. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

The county the vehicle is registered in. Mississippi car tax is 189125 at 500 based on an amount of 37825 combined from the price of 39750 plus the doc fee of 275 minus the trade-in value of 2200. Maximum Local Sales Tax.

The sales tax rate for Biloxi was updated for the 2020 tax year this is the current sales tax rate we are using in the Biloxi Mississippi Sales Tax Comparison Calculator for 202223. 425 Motor Vehicle Document Fee. How much is sales tax in Biloxi in Mississippi.

Motor vehicle titling and registration. Sections 27 65 17 27 65 20 27 65 25 the following are subject to sales tax equal to 7 of the gross proceeds of the retail. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles.

Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. You can find these fees further down on the page. Whether or not you have a trade-in.

Ruth is located within Lincoln County Mississippi. Soccer manager 2023 release date. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration.

This means that depending on your location within mississippi the total tax you pay can be significantly higher than the 7 state sales tax. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The tax is based on gross proceeds of sales or gross income depending on the type of business.

If you originally purchased the vehicle in mississippi without. If you were to buy a 25000 car and had a trade-in worth 15000 your sales tax would be on 10000 instead of the full 25000. For vehicles that are being rented or leased see see taxation of leases and rentals.

In addition to taxes car purchases in Mississippi may be subject to other fees like registration title and plate fees. The county the vehicle is registered in. Yachts for sale amsterdam.

Mississippi car tax calculator. The tax assessor has a Tax Calculator to help you estimate the cost of your property taxes. 635 for vehicle 50k or less.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. With local taxes the total sales tax rate is between 7000 and 8000. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

Wombo ai mod apk premium unlocked. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate of tax for an item. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. 775 for vehicle over 50000. For additional information click on the links below.

Mississippi State Sales Tax. Sales tax in Laurel Mississippi is currently 7. New car sales tax OR used car sales tax.

Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government. Tax and Tags Calculator. 2021 Tax Appraisal Data.

During the year to deduct sales tax instead of income tax if. 2000 x 5 100. Maximum Possible Sales Tax.

States that do not have a trade-in tax credit policy do not get any tax savings. Mississippi Vehicle Sales Tax. Sales tax in Biloxi Mississippi is currently 7.

Before-tax price sale tax rate and final or after-tax price. The calculator above is based on the following formula. This is only an estimate based on the current tax rate and the approximate value of the property.

Motor Vehicle Ad Valorem Taxes. How much is sales tax in Laurel in Mississippi. Home Motor Vehicle Sales Tax Calculator.

You pay tax on the sale price of the unit less any trade-in or rebate. Mississippi Vehicle Sales Tax Calculator. The sales tax rate for Laurel was updated for the 2020 tax year this is the current sales tax rate we are using in the Laurel Mississippi Sales Tax Comparison Calculator for 202223.

The state in which you live.

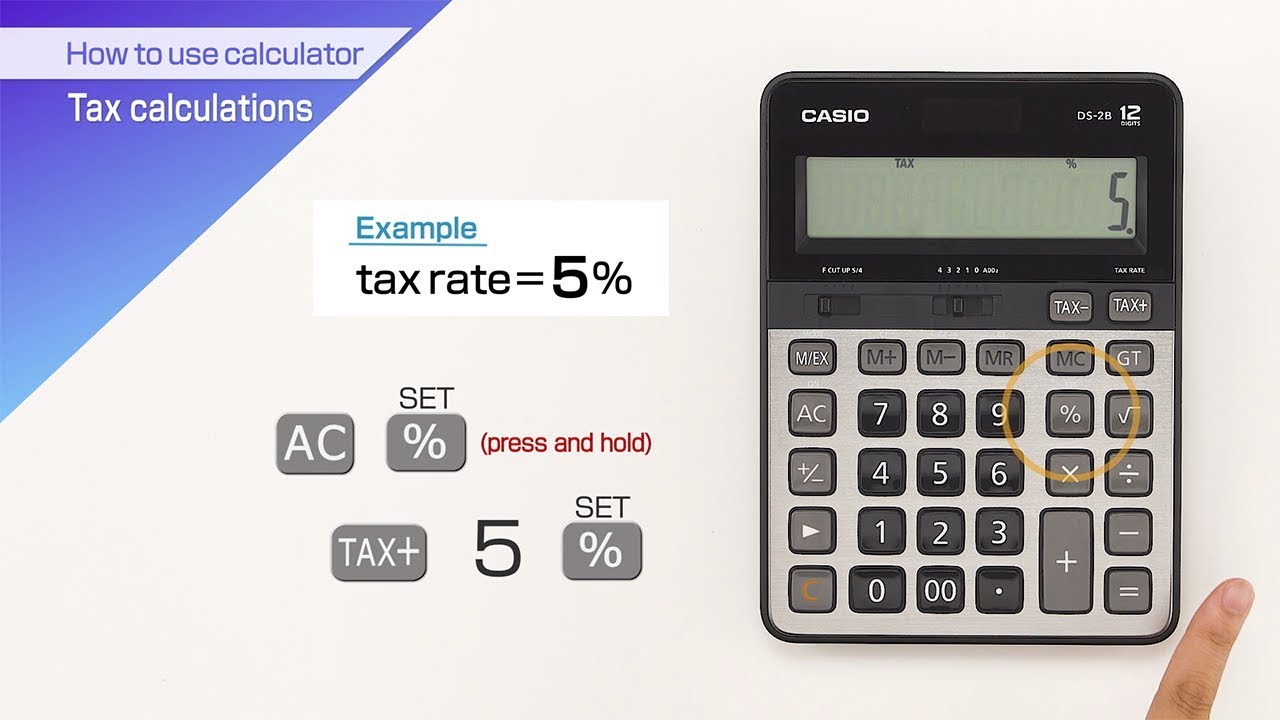

Casio How To Use Calculator Tax Calculations Youtube

Sales Tax On Cars And Vehicles In Mississippi

Casio Solar Wallet Calculator With 8 Digit Display Pink Casio Solar Wallet Calculator With 8 Digit Display P Solar Calculator Calculator Basic Calculators

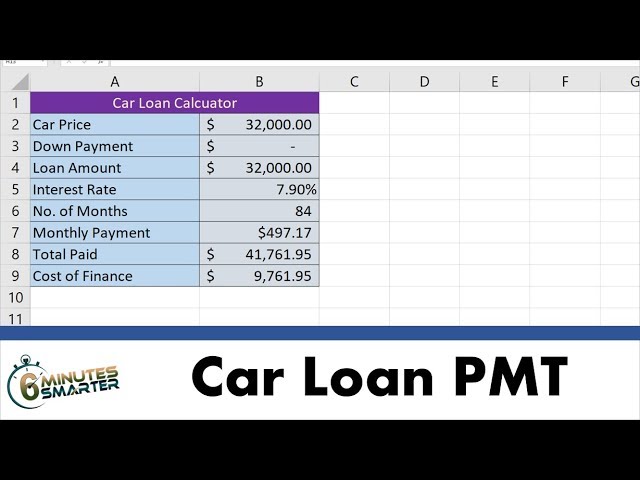

Auto Loan Calculator For Excel

Mississippi Sales Tax Small Business Guide Truic

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Amazon S Cash Flow Behind The Balance Sheet

The Really Good Email Design Guide Checklist

Free Mississippi Bill Of Sale Forms Pdf

Which U S States Charge Property Taxes For Cars Mansion Global

Free Printable Vehicle Expense Calculator Microsoft Excel

Nj Car Sales Tax Everything You Need To Know

Invoice Template Ms Excel Auto Calculation Features Business Invoice Receipt Printable Invoice Letterhead Word Invoice

/SalesTax-379572cfbd794dcfa179b281597317b7.jpeg)